Section 45 of the Residential Tenancies Act –

Landlord responsibilities

Section 45(1) of the Residential Tenancies Act 1986 (RTA) lists the Landlord Responsibilities, with the most important, or perhaps most obvious responsibilities being at the beginning, which is where we will focus for the purpose of this article.

It is important to be aware that failure by the landlord to comply with any of paragraphs (a) to (ca) below is declared to be an unlawful act and may attract exemplary damages payable to the tenant of up to $7,200. In recent cases, the Tenancy Tribunal has awarded tenants $4,000 in exemplary damages for premises being provided to tenants when they do not meet a reasonable state of cleanliness.

- Provide the premises in a reasonable state of cleanliness – It is a reasonable expectation for anyone moving into a new home, whether a purchaser or a tenant, or even hiring an Airbnb or a hotel room, that the premises are reasonably clean, and it is the landlord’s responsibility to ensure a rental premises meets this Your property manager understands the ‘reasonably clean’ standard, however interestingly, tribunal adjudicators have stated in tribunal decisions that there is an expectation that landlords will professionally clean a rental premises between tenancies, therefore acknowledging that there is a difference between the expectation of ‘reasonably clean’ when a tenant vacates, to the standard expected of ‘reasonably clean’ when a tenant moves in.

“The landlord shall provide and maintain the premises in a reasonable state of repair….”.

- When a tenancy commences, the property must be provided in a reasonable state of It is an unlawful act to provide a property in disrepair, and rather to get the work performed after a tenant has moved in.The next requirement is that the premises must be maintained in a reasonable state of repair. This includes any fixtures or fittings, or chattels. For example, if the property is rented with an alarm system and the alarm stops working during a tenancy, the landlord must repair or replace it. This is the same as an old fridge. You cannot include an item on the Tenancy Agreement in an ‘as is where is’ state, and then decide not to repair it. In this case, the landlord would be well advised to remove any item they do not intend to maintain. Interestingly in the past few years since the Healthy Homes Guarantee Act became law, the healthy homes standards (HHS) are cited in complaints and referenced in tenancy tribunal hearings when properties are not in good repair,however not all homes are required to meet the healthy homes standards, yet.

All private rentals must comply with all five of the healthy homes standards within 90 days of any new or renewed tenancy after 1 July 2021, with all private rentals complying by 1 July 2024.

The healthy homes standards provide minimum standards for heating, ventilation for kitchens and bathrooms, moisture ingress and drainage, insulation (additional to 2019 legislation) and draught stopping.

Providing and maintaining premises in a reasonable state of repair has nothing to do with the healthy homes standards and has everything to do with being a requirement of the Residential Tenancies Act 1986

Maintenance Examples vs Healthy Homes

Drainage– A standard property is likely to already have a drainage system that includes gutters, downpipes, and drains, and these need to be kept clear and working as part of the requirement to maintain a property in a reasonable state of repair. Therefore, landlords should have the gutters cleared regularly if this is necessary to ensure the drainage system is working properly. The HHS has simply made it law that all properties must now have efficient drainage systems.

Heating – Since 1947, it has been law that all properties must have a heating source in the living room, not just rental premises. Although some interpreted this to mean that a power point in the living room was sufficient as a heater can be plugged into the power point, this argument has not held up in recent tribunal cases. So, prior to the HHS, any heating source was acceptable, however now, the HHS heating standard states that the heat source must be fixed, efficient and meet the minimum heating capacity for the main living room.

Ventilation – If a property had an extraction fan in the bathroom, then it needs to be working. With the HHS, extraction fans must be ducted outside and any new fans since July 2019 must meet minimum requirements. Regardless, they must always be in working order.

Draught stopping – For the HHS draught stopping standard, landlords must make sure the propertydoesn’t have unreasonable gaps or holes in walls, ceilings, windows, skylights, floors and doors which cause noticeable draughts. However, a property in a reasonable state of repair does not have holes in the wall and it would be completely unreasonable to rent a property in this state. We don’t need the healthy homes standards to tell us this.

A property is not required to have a healthy homes assessment done between each tenancy, because quite simply, it is already legislated in the RTA that the premises must be maintained. So, once a property has been upgraded, or appliances installed, it is the landlord’s responsibility to ensure that these are maintained and are in good working order for the duration of the tenancy.

(ba) Smoke alarms – Smoke alarms protect both the occupants/tenants and the property, and Harcourts encourages all landlords to comply with industry best practice and have the supply and testing of smoke alarms outsourced. Your property manager can recommend suitably qualified and experienced companies for this service.

(bb) Healthy homes compliance – Landlords must meet the healthy homes standards by the compliance date for their current tenancy, or by 1 July 2024, whichever is sooner. Harcourts advice is to meet the standards as soon as possible to retain great tenants.

(bd) Contaminants – There are regulations being developed by Government setting out acceptable levels of meth contamination, however these are not in place yet. Always get advice from your property manager if you suspect that your property may be contaminated.

Compliance – Landlords have an obligation to ensure that any premises that are rented must be lawful and in good condition and must comply with all legal requirements before being rented out. This includes requirements around buildings, health, and safety.

There are other responsibilities listed on Section 45(1) (included) which are likely to be self- explanatory. Contact your property manager if you have any questions.

Section 45 – Landlord Responsibilities

- The landlord shall—

- provide the premises in a reasonable state of cleanliness; and

- provide and maintain the premises in a reasonable state of repair having regard to the age and character of the premises and the period during which the premises are likely to remain habitable and available for residential purposes; and

(ba) comply with all requirements in respect of smoke alarms imposed on the landlord by regulations made under section 138A; and

(bb) comply with the healthy homes standards; and

(bc) [Repealed]

(bd) comply with all requirements in respect of contaminants imposed on the landlord by regulations made under section 138C(3)(c); and

- comply with all requirements in respect of buildings, health, and safety under any enactment so far as they apply to the premises; and

(ca) if the premises do not have a reticulated water supply, provide adequate means for the collection and storage of water; and

- compensate the tenant for any reasonable expenses incurred by the tenant in repairing the premises where—

- the state of disrepair has arisen otherwise than as a result of a breach of the tenancy agreement by the tenant and is likely to cause injury to persons or property or is otherwise serious and urgent; and

- the tenant has given the landlord notice of the state of disrepair or made a reasonable attempt to do so; and

- take all reasonable steps to ensure that none of the landlord’s other tenants causes or permits any interference with the reasonable peace, comfort, or privacy of the tenant in the use of the

Healthy Homes Standard Assessments

and making a plan

Did you know that if you have not had your rental property assessed for its current level of compliance with the healthy homes standards and it becomes vacant, you will not be able to re-tenant the property until you do?

Meet Bob

Let’s look at a likely scenario with our hypothetical landlord, Bob. In November, a tenant gives Bob notice to vacate his property on 12 December 2022. Bob, who lives two hours away, does not know the property’s current level of compliance with the healthy

homes standards. Bob now needs to do the following:

- Establish the required heating capacity for the main living room using the Heating Assessment Tool at

tenancy. govt.nz/heating-tool or the formula contained in schedule 2 of the RTA (HHS) Regulations 2019.

- Complete the six pages dedicated to Insulation on the compliance This is easy for Bob as he installed new insulation in July 2018. Otherwise, he may have needed a professional assessment.

- Bob needs to know what extraction fans are installed and ensure they are in good working order and ducted If they were installed after 1 July 2019, he needs to know the diameter or exhaust capacity.

- He must inspect gutters and downpipes to ensure they efficiently drain storm, surface, and ground water to an appropriate

- He needs to know if his property requires a ground moisture barrier, and if it has one installed or Bob has not looked under the house for a long time.

- Bob also needs to understand how to meet the requirements in the draught stopping standard, and he thinks this standard should be met as soon as

Bob decides that he does not have the appropriate skills to perform these checks himself, particularly determining the heating capacity using the assessment tool as measuring rooms is required. He decides to employ a professional, but there is a delay in getting an appropriately qualified assessor to inspect the property due to the demands on the industry. A date of 17 December is given, and the report will be provided within three business days. On 21 December, when the report is received, the property can be rented, and the tenancy agreement prepared with the required compliance statements.

Unfortunately, it is now close to Christmas and tenants are not moving. The property remains vacant until mid-January. Bob loses five weeks rent. Don’t be like Bob.

Bob now has several applications and has selected his preferred tenant. Bob completes the current level of compliance statement as part of preparing the tenancy agreement and now has just 90 days to meet all five of the healthy homes standards.

Bob wishes he had made a plan earlier, as he now has to pay for extraction fans and a heat pump all at once, and after a long vacancy period. Ouch!

Make a plan

On the healthy homes standards current level of compliance statement, which is required for all new and renewed tenancies, landlords must not only complete the 16- page document that discloses the property’s current level of compliance for each of the five healthy homes standards, but they will also have just 90 days from the start of any new or renewed tenancy to meet the standards. Once your property is assessed, a plan is needed to comply with the standards.

Our Property Managers are working with landlords to avoid situations and vacancy periods like those experienced by Bob, but with the time it can take to get an assessment done, scenarios like Bob’s can be commonplace.

Don’t wait for your existing tenant to get fed up with a property that doesn’t meet the healthy homes standards and give notice, only to leave you searching for a new tenant and still having only 90 days to meet the standards. Speak to your Harcourts property manager for advice, get your property professionally assessed and make your plan to meet the standards now!

Article reproduced and updated from PM Focus September 2020 edition.

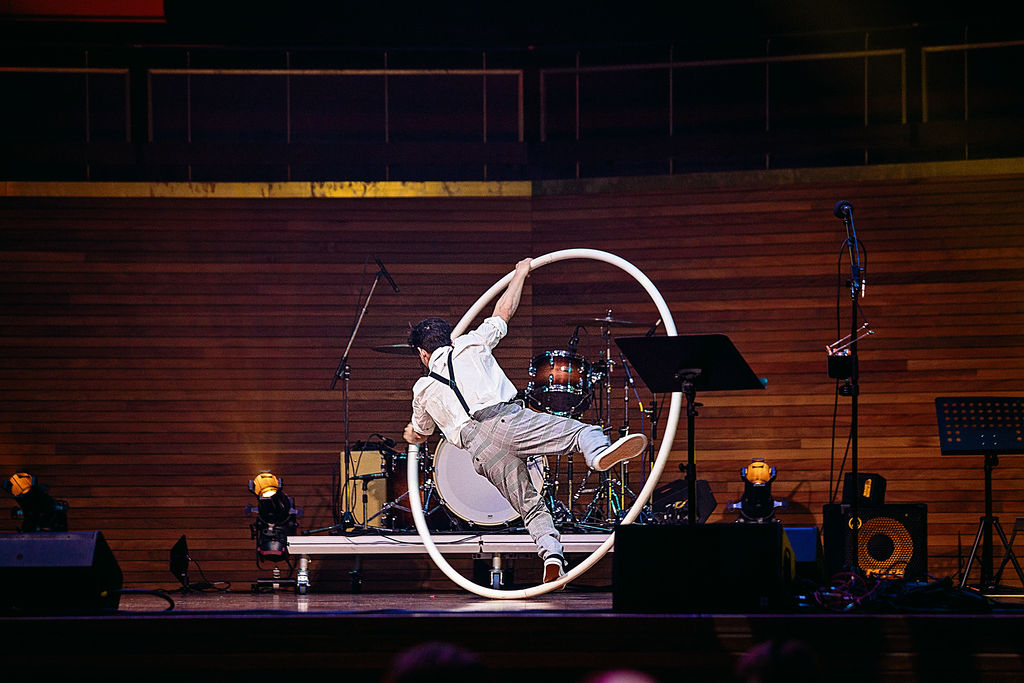

Harcourts Property Management Leadership Conference

Our leadership team at Harcourts is persistent in their strive for excellence. That’s how we offer and deliver next-level client service in Property Management.

Harcourts New Zealand’s Property Management Leadership Conference 2022 was a day of learning and collaborating on how we can provide an innovative and industry-leading approach in our work with landlords and tenants.

We were lucky enough to be joined by guest speakers – Harcourts Managing Director, Bryan Thomson, Tenancy.co.nz Managing Director Craeg Williams, Mortgage Express CEO, Sarah Johnston, and International Property Management

Trainer, Darren Hunter. In sharing their expertise, our attendees walked away with crucial insider knowledge, ready to apply to their craft and lead their teams in the pursuit of excellence.

Together with the Harcourts Foundation, Holmwood is getting behind Gumboot Friday!

Together with the Harcourts Foundation, Holmwood is getting behind Gumboot Friday!